Proximity Bias: The Hidden Trap in Venture Capital

Software engineer and founder with a background in finance and tech. Currently building aVenture.vc, a platform for researching private companies. Based in San Francisco.

Software engineer and founder with a background in finance and tech. Currently building aVenture.vc, a platform for researching private companies. Based in San Francisco.

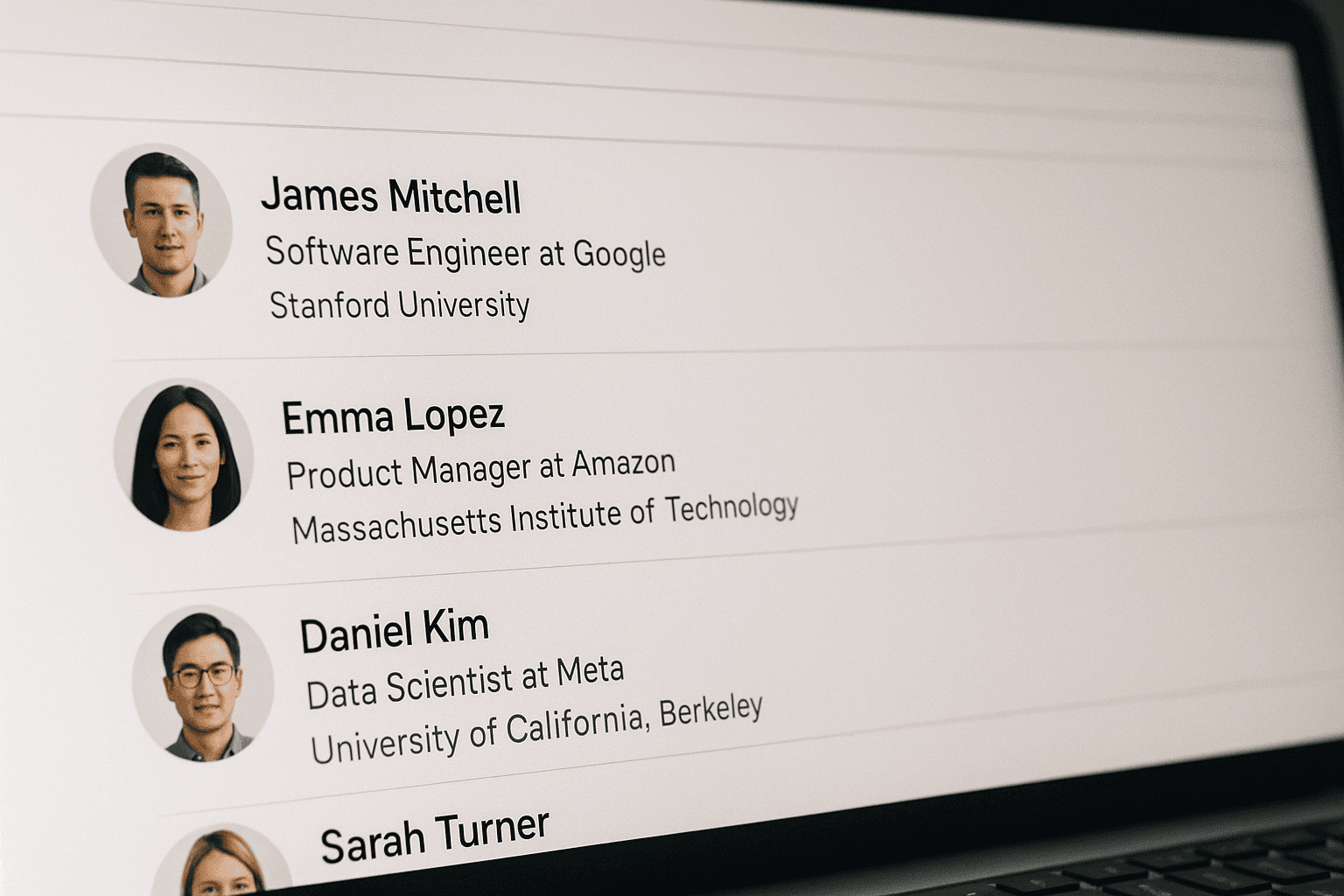

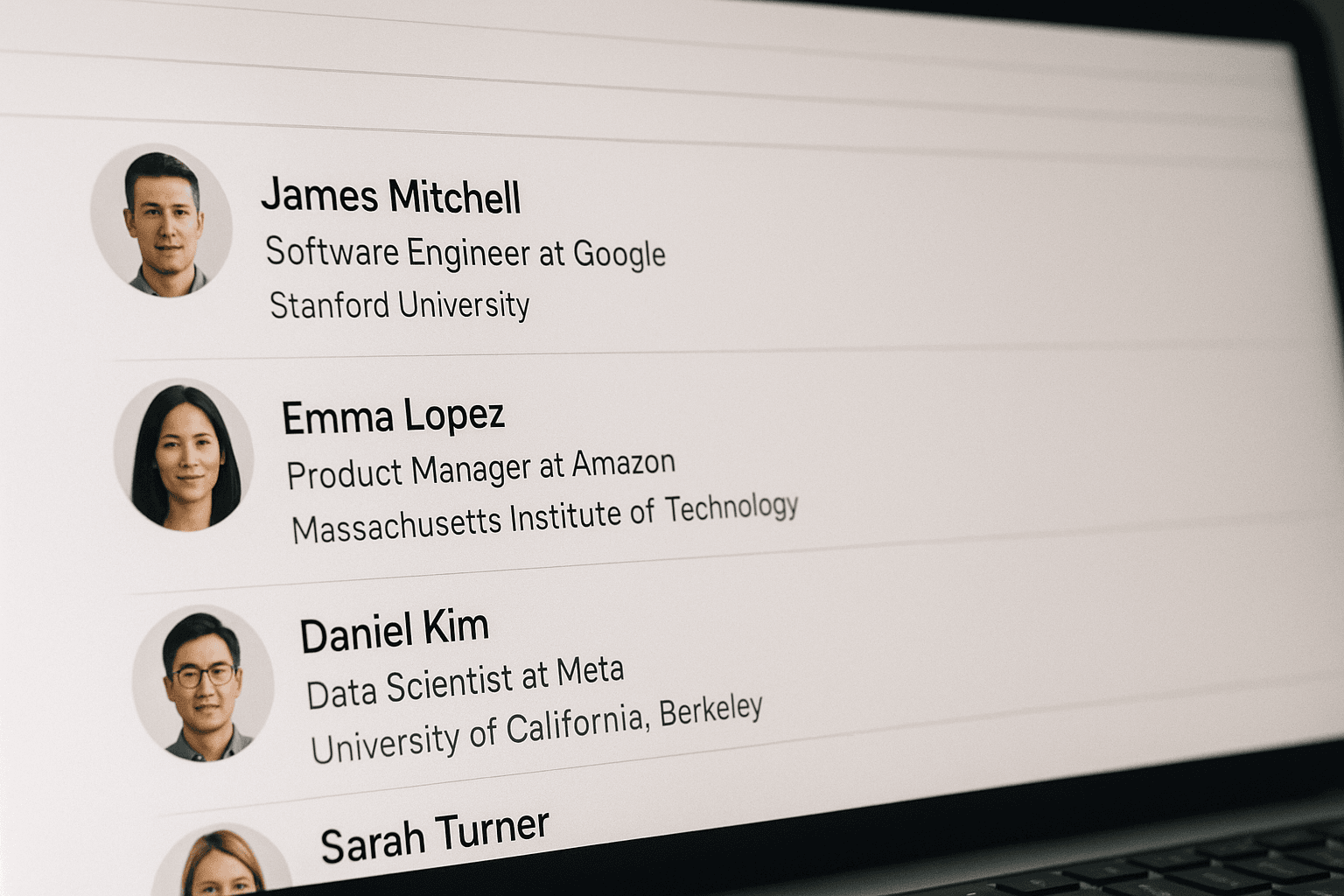

After being around the venture capital space enough, I've noticed a persistent pattern: investors often overvalue startups simply because of who the founders know or where they worked/studied. This is proximity bias, and it causes real problems.

When a founder drops "I was early at Stripe" or "I worked closely with [insert famous founder]", investors' ears perk up. I've sat in many meetings where these signals dramatically shifted the conversation - and not always for the better.

What happens: A founder's past association with successful companies or people creates an immediate halo effect. Their pitch gets more attention, their valuation creeps higher, and due diligence sometimes gets lighter. I've been guilty of this myself.

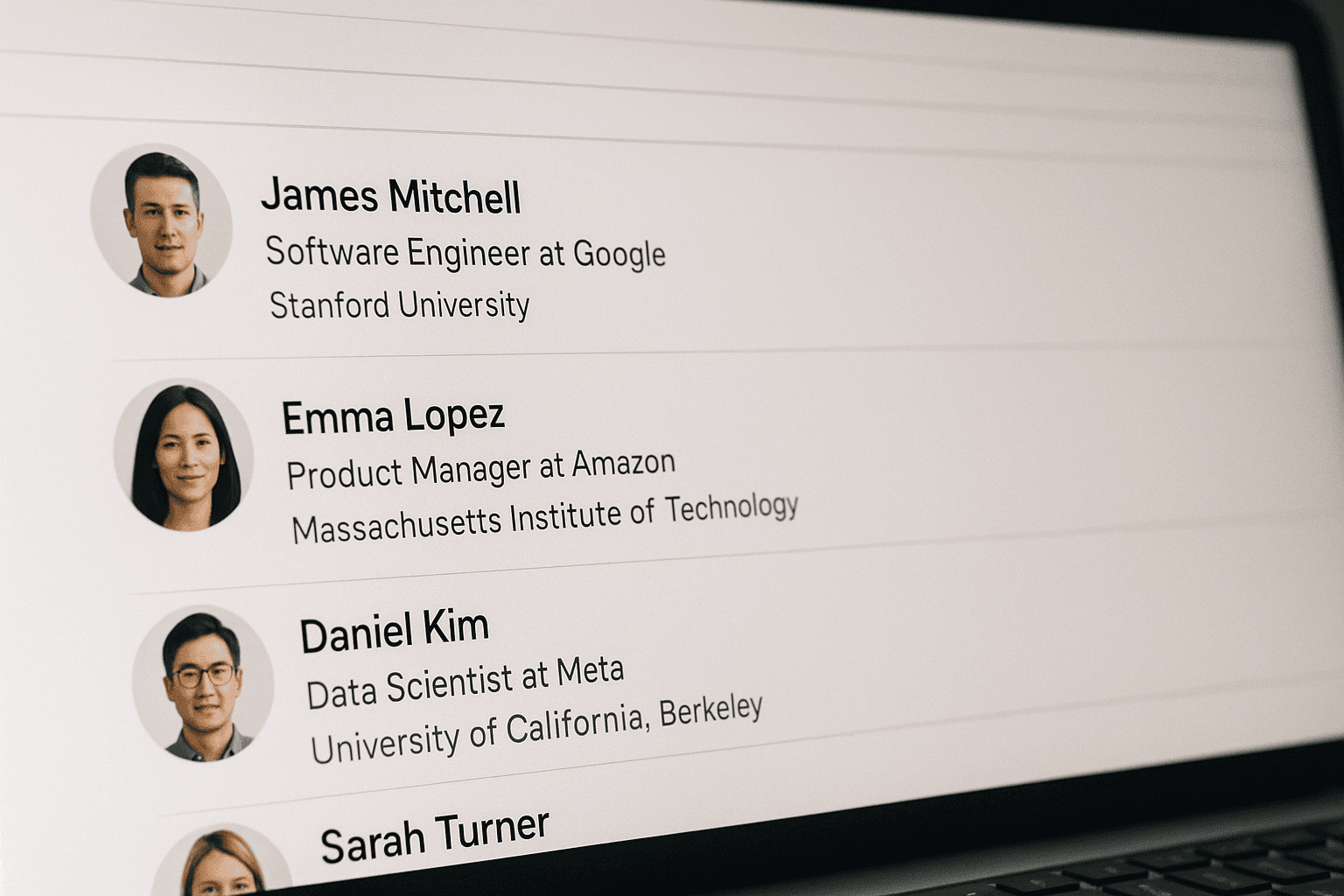

The current market downturn has exposed the flaws in this thinking. I've watched startups with strong pedigrees struggle while "outsider" founders build profitable businesses. Your time at Google or friendship with a unicorn founder doesn't guarantee you can:

At aVenture, we're building tools to help investors look beyond surface-level signals. Here's what we've learned matters more:

This is why we're building a database of venture-backed startups at aVenture. We want investors to make decisions based on data, not degrees of separation.

Want to be part of this change? We're giving early access to our startup research platform at aventure.vc

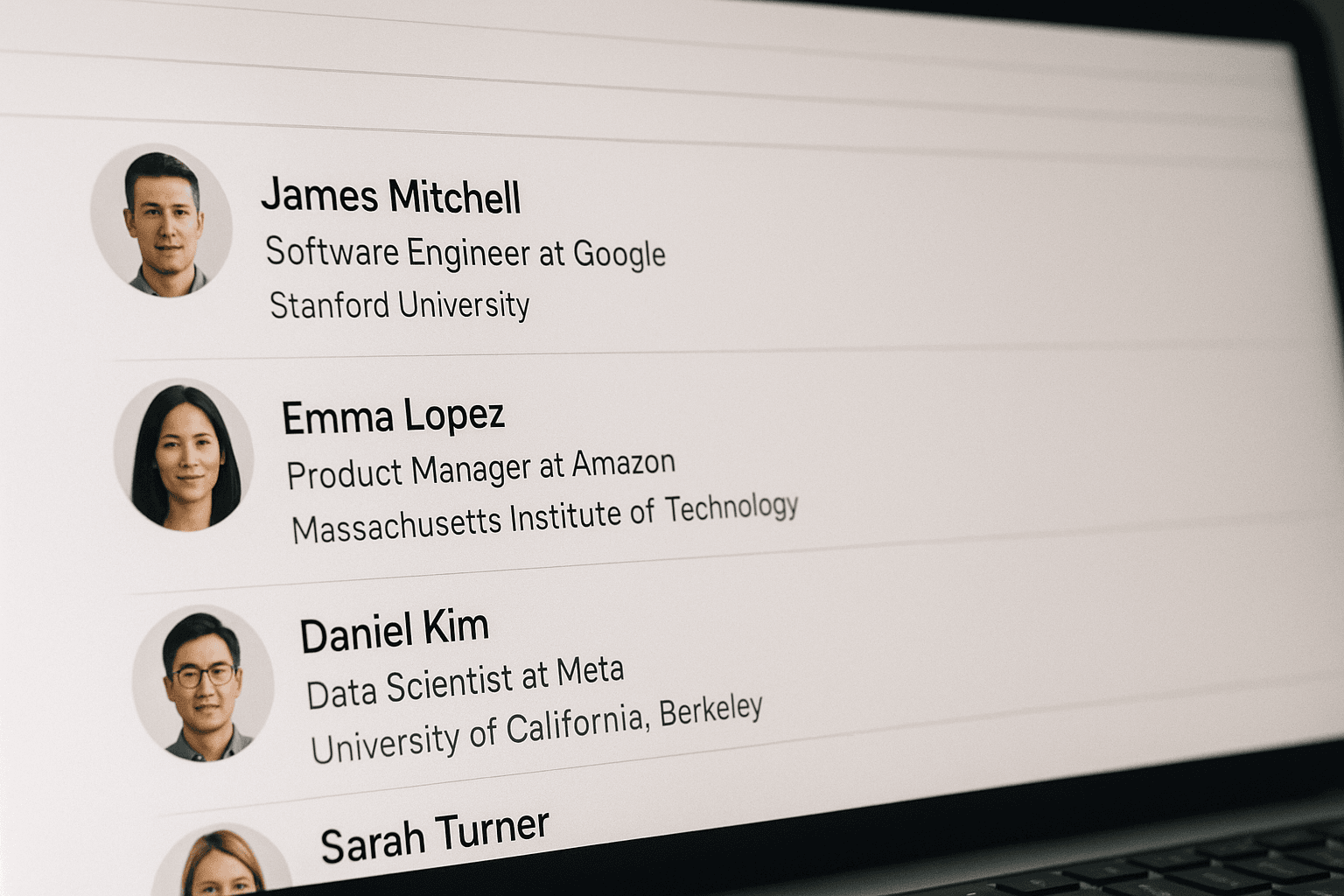

We're seeing a shift in how the best VCs evaluate deals. Instead of relying on network effects, they're:

The venture capital industry is at a crossroads. While pattern matching and proximity signals have been reliable shortcuts in the past, the democratization of startup creation means we need better evaluation frameworks.

What matters isn't where founders came from, but where they're going. The most successful VCs of the next decade will be those who can look past surface-level signals and dig deeper into the fundamentals that drive startup success.